Finder’s Bitcoin Price Predictions Report: Panel predicts Bitcoin to exceed $100K in 2024

-

The panel predicts Bitcoin (BTC) will peak at US$122K in 2024

-

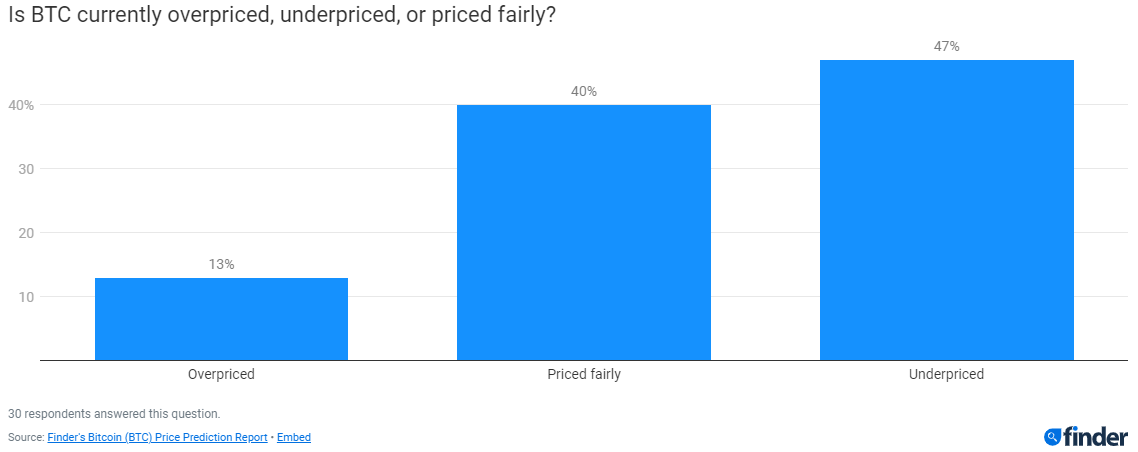

13% of crypto and fintech specialists think BTC is currently overpriced

-

BTC predicted to hit $151K by the end of 2025 and $567K by the end of 2030

PRESS RELEASE – Bitcoin (BTC) could top US$100K this year, according to the 31 crypto and fintech specialists surveyed for Finder’s latest Bitcoin Price Predictions Report.

The panel predicts BTC will peak at $122K in 2024, before ending the year at $109K.

Several panellists, including ForexTraders senior cryptocurrency and forex analyst Nick Ranga, attribute the rally to growing institutional adoption and capital flowing into spot bitcoin ETFs. Ranga thinks BTC will peak and end the year at $100K.

“The primary catalyst of the current crypto bull market has been the vast inflow of institutional capital following the SEC’s approval of the first Bitcoin Spot ETFs. Demand is already outstripping supply, reportedly by a factor of 10.

“This is coupled with the anticipated supply shock of the upcoming halving event, where the supply of new Bitcoins entering the market is cut in half. Retail investors are also returning to crypto, with many exchanges reporting an increase in new registrations.”

Market Research Future senior market research analyst Shubham Munde believes the halving event will lead to an uptick in BTC’s price, but gave slightly more moderate peak and end-of-year predictions of $95K and $91K respectively.

“The halving event is expected to cause a significant surge in the BTC price if we compare the previous trends. BTC demand is constantly increasing and hence its value will increase substantially since institutional and retail investors are constantly growing.”

However, Associate Professor at Nottingham Trent University Jeremy Cheah thinks BTC will peak at $100K before ending the year at $75K and expects the hype around the halving will dissipate once the event occurs.

When asked about their thoughts on how BTC is currently priced, 47% believe that it’s underpriced, while an additional 40% say BTC is priced fairly.

However, 13% of the panel, including University of Canberra senior lecturer John Hawkins, claim that BTC is currently overpriced. Hawkins predicts that BTC will sink to $20K by the end of the year.

“The current run-up in price seems mainly related to the spot ETFs. But when the ETFs based on bitcoin futures were launched in Oct 2021, the price also reached an all-time high, only to crash over the following year.

“Having ETFs still does not give Bitcoin any fundamental value or legitimate use. It remains a speculative bubble.”

Looking further ahead, on average, the panel predicts BTC will be worth $151K by the end of 2025 and $567K by the end of 2030.

While Swinburne University of Technology senior lecturer Dimitrios Salampasis gave a 2030 prediction in line with the panel average at $550k, he cautions that BTC is still a volatile asset that is driven solely by supply and demand.

“There are multiple conflicting and unpredictable factors associated with Bitcoin’s behavior therefore we may end up seeing substantial fluctuations in its price and value.

“Regulation, increasing cost of living and monetary reactions from centralised finance will be the main contributing factors to Bitcoin’s price.”

The majority (61%) of Finder’s panel say it’s time to buy BTC before the halving event, while 32% say it’s time to hold and just 6% sell.

You can find the full report here: https://www.finder.com/uk/

If room: