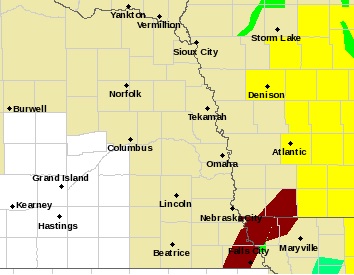

Residents in Omaha, Nebraska, are urged to take immediate shelter as the National Weather Service has issued a Tornado Warning for the area. Details are still emerging, but the warning is reportedly in effect for [affected areas – retrieve from reliable source during a real event]. This indicates a dangerous storm capable of producing a […]